Did you know that the mobilization of more than 100 million women into about 9.1 million SHG Self Help Group, under the DAY – NRLM project, has ignited a revolutionary movement in rural India.

Furthermore, the significant allocation of approximately ₹7.68 trillion in bank loans since 2013-14 highlights the immense influence of this program in strengthening rural populations.

SHG Overview: Understanding Self Help Groups

A Self Help Group, which emerged in the 1970s, is a group that acts as a financial mediator and is usually made up of 12 to 25 women from the local community.

These groups comprise individuals encountering comparable economic difficulties who unite to provide mutual assistance and address shared issues. It promote the practice of saving small amounts of money among their members.

These savings are then pooled together and put in a collective fund that is managed by a bank in the name of the SHG. It is crucial to emphasize that it function in an informal manner.

It is not obligatory to register them under any formal organization such as a Societies Act, State Cooperative Act, or partnership company.

SHG Self Help Group History

In the 1970s, Professor Mohammed Yunus introduced the idea of SHG in Bangladesh, with the aim of encouraging the poorest individuals to save and practice thrift.

In 1976, the Grameen Bank was founded, introducing a groundbreaking approach to banking that prioritized providing loans to small groups, particularly women, who aimed to launch small-scale enterprises.

These groups, which originated from the initiatives of Grameen Bank, have significantly contributed to the reduction of poverty in rural India.

In addition to providing financial services, they cultivate a feeling of belonging and encourage members, particularly women, to actively participate in saving, borrowing, and socio-economic endeavors, resulting in significant changes in both individual lives and communities.

What are SHG and SHG full form?

Self Help Groups are unstructured organizations formed by individuals who collaborate to enhance their quality of life. Typically, they have the ability to rule themselves and are regulated by their peers.

Individuals with comparable economic and social circumstances usually establish associations facilitated by non-governmental organizations (NGOs) or government agencies in order to address their concerns and enhance their quality of life.

Size of the SHG and SHG Formation

- An optimal number of members for a Self Help Group is typically between 10 and 20 individuals.

- Registration of the group is not necessary.

SHG 5 sutras

Follows ‘Panchsutra’ i.e.

(i) Regular meetings

(ii) Regular savings

(iii) Regular inter-loaning

(iV) Timely repayment

(V) Up-to-date books of accounts

Evolution of Self Help Group (SHG) in India

The Early Years (1985-1987)

In the 1980s, MYRADA in India established them as a solution to the difficulties faced by members of big cooperatives in repaying loans.

MYRADA proposed the formation of smaller groups, which resulted in the establishment of groups consisting of 15-20 members. They acquired knowledge in financial management, conducted meetings in an organized manner, and established a foundation of trust.

Phase I: From 1987 to 1992

During the period from 1987 to 1992, the National Bank for Agriculture and Rural Development (NABARD) provided assistance to non-governmental organization (NGO) programs aimed at supporting groups.

MYRADA obtained funding from NABARD in 1987 to identify affinity groups and align their finances. In 1990, the Reserve Bank of India (RBI) acknowledged their strategy as a viable lending model. This led to the official establishment of the SHG Bank Linkage Programme in 1992.

Phase II: From 1992 Onwards – SHG Bank Linkage Programme

The second phase commenced in 1992 with a pilot initiative that acquired significant traction, resulting in the involvement of about three million groups and the connection of 1.6 million SHGs to banks by March 2006.

The Indian government implemented the Swarn Jayanti Gram Swarozgar Yojana (SGSY) in 1999 with the aim of fostering self-employment in rural regions by establishing groups and enhancing vocational abilities.

In 2011, the National Rural Livelihoods Mission (NRLM) emerged as the world’s largest initiative aimed at reducing poverty.

Functions of SHG

- Their objective is to enhance the functional capacity of economically disadvantaged and marginalized segments of society in the areas of employment and revenue generation.

- They provide loans without requiring collateral to those who typically struggle to obtain loans from traditional banks.

- Conflicts are resolved through mutual discourse and communal leadership.

- They also promote the practice of saving among impoverished individuals.

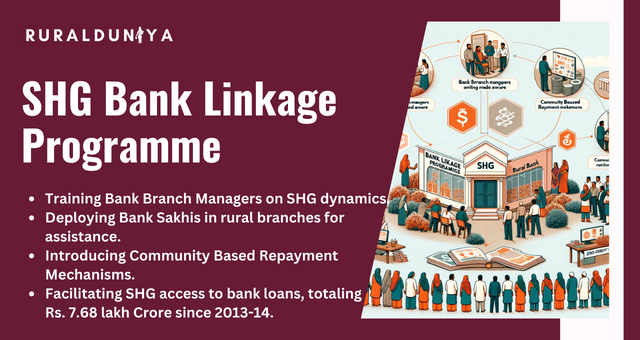

SHG Bank Linkage Programme

The components of SHG Bank linkage programme are as follows:

- The process of educating and raising awareness among Bank Branch Managers.

- The process of educating and placing Bank Sakhis at Rural Bank Branches.

- Implement Community Based Repayment Mechanism (CBRM) in Rural Bank Branches

- SHG Credit Linkage

As of November 2023, Self Help Groups have accessed Bank loans amounting to Rs. 7.68 lakh Crore from the fiscal year 2013-14.

Benefits of SHG

- Economic Empowerment: In rural Rajasthan, women belonging to groups have started businesses like as dairy farming, leading to a rise in household incomes and initiatives like Drone Didi and Lakhpati Didi are supporting them.

- Skill Development: Tamil Nadu Self Help Groups provided training to women, enabling them to develop their skills in weaving and become expert artisans.

- Financial inclusion: Karnataka groups provided microcredit to support agricultural investments.

- Asset Ownership: West Bengal’s group women have expanded their sources of income by engaging in chicken farming and opening grocery businesses through schemes.

- Awareness and Education: Self Help Groups in Andhra Pradesh successfully enhanced community knowledge on sanitation.

- Community Impact: Amidst the COVID-19 pandemic, the groups of Kerala’s “Kudumbashree” took the initiative to manufacture masks and distribute meals.

- Political Empowerment: Women belonging to these groups in Haryana actively engage in local elections, hence enhancing the level of representation at the grassroots level.

Shift from the National Rural Livelihood Mission (NRLM) to State Rural Livelihood Missions (SRLMs)

The shift from NRLM to SRLMs represented a deliberate dispersion in livelihood programs. The NRLM offered comprehensive instructions on a national scale, while the SRLMs permitted customized actions at the state level, taking into account the varied socio-economic conditions.

SRLMs function within the framework of NRLM but adapt their tactics to suit local requirements, in accordance with the distinct goals and problems of each state.

Not An End

SHG has made a substantial impact on reducing poverty and empowering women in India.

It is necessary to address difficulties such as universal mobilization, capacity building, financial inclusion, varied livelihoods, community support systems, and schematic convergence in order to increase their impact.

By prioritizing these specific areas, Self Help Group can effectively promote sustainable and inclusive growth for those who are economically disadvantaged.

FAQs

What does SHG stand for?

SHG is an acronym for Self help Group.

Who introduced SHG in India?

NABARD initiated a widespread promotion of self help groups in 1991-92. It served as the true starting point for the ‘SHG movement’.

What are the three pillars of Self Help Group?

• SHGs and financial inclusion

• SHGs and political empowerment

• SHGs and economic empowerment

How many members are in SHG?

Ideal size of an group is 10 to 20 members.

Who is the leader of SHG?

The selection of the leader is determined by the group members, and the leadership position is periodically cycled among different members.

Nishank is a social impact enthusiast with a solid foundation in public policy, micro-enterprise, and agribusiness. Growing up in a farmer’s family has given him a profound connection to rural communities, fueling his passion to empower people towards self-reliance. He completed his undergraduate studies at the Delhi University and earned a master’s degree in Rural Management from National Institute of Rural Development & Panchayati Raj in Hyderabad.