Ohh, you are interested in acquiring information regarding the Fasal Bima Yojana, also known as the Pradhan Mantri Fasal Bima Yojana (PMFBY).

The Yojana provides insurance coverage to farmers in case of unexpected disasters that cause crop loss or damage. It is currently the third largest insurance policy in the world in terms of premiums.

Fasal Bima Yojana Scheme: All Details

The Fasal Bima Yojana offers extensive protection to farmers against various unexpected crop losses. Agriculture, which sustains the livelihoods of nearly 58% of India’s population, surpasses all other sectors combined.

Agricultural production exhibits significant volatility as a result of unpredictable weather patterns, extensive reliance on rainfall, and the prevalence of pests and diseases.

The Government of India launched the Pradhan Mantri Fasal Bima Yojana (PMFBY) in February 2016, replacing previous schemes such as the National Agricultural Insurance Scheme (NAIS), Weather Based Crop Insurance Scheme, and Modified National Agricultural Insurance Scheme (MNAIS).

Pradhan Mantri Fasal Bima Yojana Objectives

The objective of the PMFBY is to provide assistance for the promotion of sustainable agricultural output.

- The primary goals of the initiative are to offer monetary assistance to farmers who have experienced crop loss or damage due to unanticipated circumstances.

- Ensuring the financial stability of farmers to guarantee their ongoing participation in agriculture.

- Promoting the adoption of cutting-edge and contemporary agricultural techniques among farmers.

- Facilitating the provision of finance to the agriculture sector, thereby promoting food security, crop diversity, and the expansion and competitiveness of the agriculture sector.

Fasal Bima Yojana Benefits

Yojana offers a wide range of advantages. Below, we have outlined the benefits and features that we offer.

- Exceptionally affordable premium.

- Complete coverage for the financial value of crops lost as a result of natural disasters.

- Enhance the profitability of agriculture.

- Motivate the farmers.

- Straightforward online application process.

- Web-based tool for calculating insurance premiums.

- Availability of a helpline that operates 24 hours a day.

Pradhan Mantri Fasal Bima Yojana Crops Covered

All crops that fall under the categories of Food Crops (Cereals, Millets, and Pulses), Oilseeds, and Annual Commercial/Annual Horticultural Crops are included.

- Various crops such as paddy, wheat, and millet.

- Examples of crops that can be classified as cotton, jute, and sugarcane.

- Arhar, gram, pea, soybean, green, urad, cowpea, and other legumes are well-known.

- The following are examples of several types of oilseeds: Sesame, Mustard, Endive, Cottonseed, Groundnut, Soybean, Sunflower, Toria, Safflower, Linseed, Niger Seeds, and others.

- The list includes fruits and vegetables such as banana, grape, potato, onion, cassava, cardamom, ginger, turmeric, apple, mango, orange, guava, lychee, papaya, pineapple, sapodilla, tomato, peas, and cauliflower.

Fasal Bima Yojana Eligibility

Eligibility for PMFBY –

- All farmers who have received Seasonal Agricultural Operations (SAO) loans (Crop Loans) from Financial Institutions (FIs), namely those who have borrowed money, for the designated crop(s) season will be included without exception.

- Scheme is not mandatory for farmers who are not borrowers.

Fasal Bima Yojana Premium

| Type of Crop | Kharif | Rabi |

| Food grains including Cereals, Pulses and Oilseeds | 2% | 1.5% |

| Annual Horticulture and Commercial Crops | 5% | 5% |

Once the Bidding process is completed, if the Insurance Company’s premium rate is higher than the rates mentioned above, the State and Government of India will each contribute 50% of the difference to the Insurance Company as a premium subsidy.

If the rate is lower than the rates mentioned above, the Insurance Company will not receive any subsidy.

Fasal Bima Yojana Apply

To avail oneself of the scheme, please access the official website.

- Navigate to the “Farmer Corner” section and choose the option “Guest Farmer”

- Complete the application form by providing the essential information

- Attach the needed papers to the application

- Remit the insurance premium – Submit the completed form

Pradhan Mantri Fasal Bima Yojana Documents Required

In order to get this advantage by submitting an application under this programme, the farmer must possess all of these documentation.

- Aadhar Card.

- Bank account passbook.

- Khaasra number refers to a unique identification number assigned to a specific plot of land.

- A Sowing Certificate is a document that certifies the act of planting seeds or crops on a piece of land.

- A Village Patwari is a government official responsible for maintaining land records and providing various administrative services in a village.

- Documents pertaining to land.

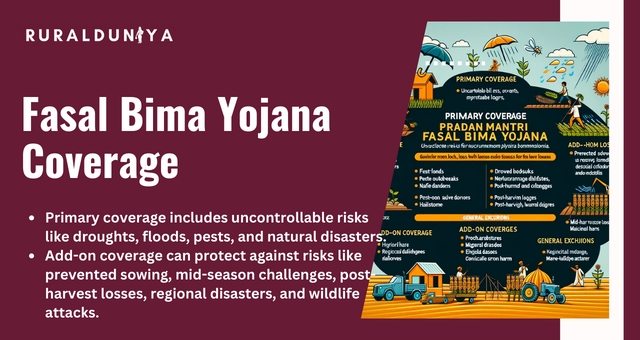

Fasal Bima Yojana Coverage

The Scheme covers the various stages of agricultural cultivation that pose hazards and may result in crop loss. The State Government is not allowed to introduce any additional hazards other than the one specified below.

Primary coverage:

The loss was caused by uncontrollable risks such as drought, dry periods, flood, inundation, widespread pest and disease outbreaks, landslides, natural fires caused by lightning, storms, hailstorms, and cyclones.

Add-on Coverage:

In addition to the compulsory Basic Coverage, the State Governments/UTs, in collaboration with the State Level Coordination Committee on Crop Insurance (SLCCCI), have the option to select any or all of the supplementary covers listed below, depending on the requirements of the particular crop/area in their State. These covers are designed to protect against various stages of the crop and risks that may result in crop loss, such as:

- Risk of prevented sowing/planting/germination.

- Mid-Season Challenges such as extended periods of little to no rainfall, severe droughts, and floods.

- Losses that occur after the harvest.

- Regional Disasters.

- Additional insurance coverage for crop damage caused by wildlife attacks.

General exclusions encompass losses resulting from war, nuclear dangers, malicious harm, and other avoidable risks.

Fasal Bima Yojana Claim

Claims will be determined using the loss assessment report produced by the District Level Joint Committee (DLJC) and/or the average yield submitted by the relevant State Government.

Final Thoughts

Any nation committed to its developmental objectives must recognise the need of providing insurance coverage to farmers to protect them from unforeseen losses. Agriculture is the most significant private sector industry in India.

Due to the ineffectiveness of National Agricultural Insurance Schemes (NAIs), the Fasal Bima Yojana was implemented nationwide non 2016.

It is significantly superior to NAIs. The PMFBY has been implemented in a methodical manner and has gained significant popularity among farmers since its establishment.

FAQs

When was the PMFBY scheme launched?

Starting in Kharif 18 February 2016, the Ministry of Agriculture & Farmers Welfare, New Delhi started the PMFBY scheme.

What is the age limit for Pradhan Mantri Fasal Bima Yojana?

All farmers between the ages of 18 and 70 who are eligible for crop insurance under PMFBY.

How many days are required for crop insurance claim?

Farmers can notify insurance companies within 72 hours. Within 15 days of damage, damages will be assessed.

Who introduced crop insurance?

The ‘General Insurance’ Department of Life Insurance Corporation of India started the first crop insurance programme on H-4 cotton in Gujarat in 1972-73.

What is the slogan of PMFBY?One Nation, One Crop, One Premium

One Nation, One Crop, One Premium.

Nishank is a social impact enthusiast with a solid foundation in public policy, micro-enterprise, and agribusiness. Growing up in a farmer’s family has given him a profound connection to rural communities, fueling his passion to empower people towards self-reliance. He completed his undergraduate studies at the Delhi University and earned a master’s degree in Rural Management from National Institute of Rural Development & Panchayati Raj in Hyderabad.