Have you ever wondered how you can plan for a secure and happy retirement? The NPS Vatsalya Scheme is here to make it possible!

This retirement savings scheme under the National Pension System (NPS) is specially designed for financial security post-retirement.

NPS Vatsalya Scheme: Secure Your Financial Future

The NPS Vatsalya Scheme is a specialized retirement savings scheme under the National Pension System (NPS) in India.

Designed to provide financial security and stability post-retirement, this scheme encourages individuals to contribute regularly during their working years and reap significant benefits in their later life.

With the backing of the Government of India, the Vatsalya Yojana has become a cornerstone for long-term financial planning. It is ideal for individuals seeking tax-efficient and disciplined retirement savings.

For instance, a 30-year-old investing ₹10,000 monthly can accumulate a corpus of ₹1 crore by retirement age.

NPS Vatsalya Benefits

What makes Vatsalya Yojana stand out?

Let’s explore its amazing benefits:

- Tax Savings: Save on taxes with deductions under Section 80C and 80CCD(1B).

- Government Support: For certain groups, the government adds to your savings.

- Investment Options: Choose from multiple fund managers to suit your needs.

- Wealth Growth: Watch your savings grow with market-linked returns.

For instance, if you invest ₹2,000 monthly at 8% annual returns, you could save up to ₹50 lakh in 25 years. Isn’t that exciting?

NPS Vatsalya Eligibility

Who can join?

If you meet these criteria, you’re in:

- You’re an Indian citizen.

- You’re aged between 18 and 65.

- You have Aadhaar, PAN and other KYC documents.

A wide range of people can benefit from this scheme. For example, a 40 year old self employed professional can start saving now and still secure a comfortable retirement.

NPS Vatsalya Enrollment

Joining is super easy! Here’s how you can do it:

- Visit any authorized bank or financial institution.

- Fill out a simple form.

- Submit your Aadhaar, PAN and a small contribution.

For example, you could visit your local bank and walk out with your NPS account activated in just minutes. Sounds convenient, right?

NPS Vatsalya Registration Online

Love doing things online?

Register for Vatsalya Yojana through the NSDL portal:

- Visit the eNPS website.

- Select the “NPS Vatsalya” option.

- Complete your KYC.

- Make your first contribution.

- Get your PRAN (Permanent Retirement Account Number).

For instance, registering online takes less than 30 minutes—no need to leave your home!

How to Contribute in NPS Monthly

Wondering how to keep building your retirement savings?

Here’s how:

- Online: Use the eNPS portal or your bank’s auto-debit feature.

- Offline: Visit a designated PoP location.

- Minimum monthly contribution: Just ₹500.

Imagine setting up an auto-debit of ₹1,000 monthly. It’s effortless and ensures consistent savings!

NPS Vatsalya Government Contribution

Did you know the government can boost your savings? For specific groups, the government adds up to 14% of your salary to your account.

For instance, if your basic salary is ₹50,000, the government might contribute ₹7,000 monthly.

NPS Vatsalya Login

Want to check your savings? Here’s how to log in:

- Go to the NSDL or CRA portal.

- Enter your PRAN and password.

- Access your fund details and performance.

For example, logging in monthly helps you stay updated and motivated about your financial goals.

NPS Vatsalya Calculator

Curious about how much you can save?

Use the Vatsalya Calculator:

- Enter your monthly contribution.

- Add the expected returns (e.g., 10%).

- Enter the number of years you’ll invest.

For example, investing ₹2,000 monthly for 25 years at 10% returns can grow your fund to ₹70 lakh.

NPS Vatsalya Scheme Details

Here’s a quick overview:

- Tier I: Mandatory, with tax benefits.

- Tier II: Voluntary, flexible withdrawals but no tax perks.

For example, you could use Tier II for short-term needs while saving long-term with Tier I.

NPS Vatsalya Tax Benefit

Why pay more taxes?

With NPS, you can save up to ₹1.5 lakh under Section 80C and ₹50,000 under Section 80CCD(1B).

For instance, someone earning ₹10 lakh annually could save ₹60,000 in taxes. Doesn’t that sound like a win-win?

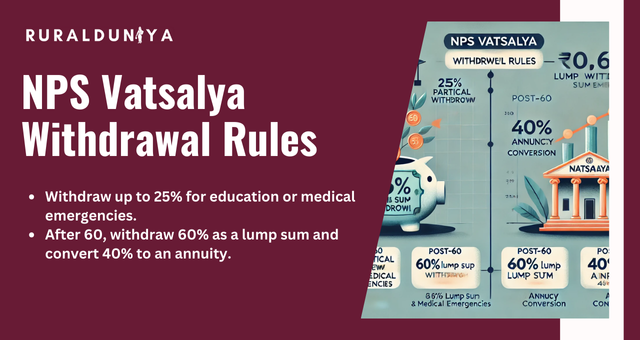

NPS Vatsalya Withdrawal Rules

Need funds?

Here are the rules:

- Withdraw up to 25% for education or medical emergencies.

- After 60, withdraw 60% as a lump sum and convert 40% to an annuity.

For example, if your corpus is ₹10 lakh, you can withdraw ₹4 lakh and enjoy regular income with the rest. Isn’t that a balanced approach?

NPS Vatsalya Exit

Ready for retirement?

Here’s what happens:

- Take 60% of your corpus as a lump sum.

- Convert the remaining 40% into monthly annuities.

For example, with a ₹50 lakh fund, you get ₹30 lakh instantly and a steady monthly income from the rest. Secure and predictable, right?

NPS Vatsalya Interest Rate

What about returns?

They’re market-linked, typically 8-12% annually.

For instance, equity funds may offer higher growth, while government bonds provide stability. A perfect mix for steady growth!

NPS Vatsalya Maturity

What happens at maturity?

At 60, you get both lump sum and annuity payments.

For example, a ₹50 lakh corpus could mean ₹30 lakh upfront and a monthly annuity of ₹20,000. Financial freedom awaits!

NPS Vatsalya Required Documents

Ready to apply? Keep these handy:

- Aadhaar and PAN.

- A recent photo.

- Address proof.

- Bank details.

For instance, submitting these online can save you a lot of time.

NPS Vatsalya Yojana Apply Online

Applying is just a click away! Visit the NSDL eNPS portal, follow the steps and you’re done.

For example, self-employed people can apply without even stepping out.

NPS Vatsalya Disadvantages

Are there any downsides?

Here are a few:

- Limited liquidity due to lock-in period.

- Returns depend on market performance.

- Some corpus must be used for annuities.

For example, if you prefer instant withdrawals, this might feel restrictive. But remember, it’s for your long-term benefit.

NPS Vatsalya for Minors

Can minors join? Not directly, but guardians can open accounts for them.

For instance, parents contributing ₹500 monthly for a child can build a solid fund by the time they turn 18. Great for future security, isn’t it?

Can NPS Be Paid Annually

Yes, you can make annual payments too. The minimum is just ₹500 per year.

For example, paying ₹12,000 annually gives the same benefits as monthly contributions, but with more flexibility.

NPS Vatsalya Minimum & Maximum Contribution

Here’s the range:

- Minimum: ₹500 annually.

- Maximum: No upper limit.

For instance, contributing ₹2 lakh annually could mean big savings and a huge retirement fund.

NPS Vatsalya Zerodha

Zerodha makes investing in NPS easier. Manage it alongside your stocks and mutual funds.

For instance, you can track all your investments in one place.

NPS Vatsalya vs NPS

What’s the difference? Vatsalya offers additional features for specific groups, while general NPS is for everyone.

For example, self-employed individuals might prefer general NPS, while government employees enjoy extra benefits under Vatsalya.

NPS Vatsalya vs Mutual Fund

How does it compare to mutual funds?

- Risk: NPS has lower risk.

- Returns: Mutual funds might offer higher growth.

- Taxes: NPS wins with tax benefits.

For example, if you’re risk-averse, NPS is your go-to. If not, mutual funds might appeal.

NPS Vatsalya NSDL

NSDL is your reliable record-keeper, ensuring transparency.

For instance, you can check transaction histories anytime.

Final Reflections

The NPS Vatsalya Scheme is your partner for a happy retirement. With tax perks, government contributions and solid returns, it’s an ideal choice for financial security.

For instance, saving just ₹1,000 monthly over 30 years can transform into a stress-free retirement. Ready to start your journey?

FAQs

What is the NPS Vatsalya Yojana?

Vatsalya Yojana is a retirement savings scheme under the National Pension System. It helps you save regularly and offers tax benefits, market-linked returns and financial security after retirement.

How can I register for NPS Vatsalya Yojana online?

You can register online through the NSDL eNPS portal by filling out your details, completing KYC with Aadhaar and PAN and making the first payment. You’ll get a PRAN number to manage your account.

What are the tax benefits of the NPS Vatsalya Yojana?

You can save up to ₹1.5 lakh under Section 80C and ₹50,000 more under Section 80CCD(1B). These deductions reduce your taxable income, helping you save more.

What happens to my money when the NPS matures?

When you turn 60, you can withdraw up to 60% of your savings as a lump sum. The remaining 40% is used to buy an annuity, which gives you regular monthly income.

Nishank is a social impact enthusiast with a solid foundation in public policy, micro-enterprise, and agribusiness. Growing up in a farmer’s family has given him a profound connection to rural communities, fueling his passion to empower people towards self-reliance. He completed his undergraduate studies at the Delhi University and earned a master’s degree in Rural Management from National Institute of Rural Development & Panchayati Raj in Hyderabad.