Hey there, farmer friends! 🌿 Ever felt the pinch when you needed cash for your farm? That’s where the Kisan Credit Card (KCC) comes in. Launched in 1998 by NABARD, this amazing card helps farmers get easy, low-interest loans for everything from seeds to machinery.

No more running around for funds—just swipe, spend, and harvest! 🌾

Kisan Credit Card Scheme Explained

So, what’s the deal with the Kisan Credit Card Scheme? 🤷♂️ It’s a government initiative designed to give farmers quick access to credit at super-low interest rates. The goal? Make farming stress-free 🎯 by cutting out those high-interest moneylenders and giving farmers the financial freedom they deserve.

With flexible repayment options, low processing fees, and government-backed subsidies, this scheme makes sure farmers get the funds they need, exactly when they need them. Plus, with the arrival of digital banking, managing your KCC online is now easier than ever.

Why Every Farmer Needs a Kisan Credit Card

- Instant Money When You Need It – No more waiting for loan approvals!

- Super Low Interest Rates – No hidden charges, just affordable farming.

- Flexible Repayment – Pay after harvest, stress-free.

- Insurance Included – Get covered under PMFBY crop insurance.

- Covers All Farming Needs – From seeds to storage, everything is covered.

- One-Time Application – Valid for 5 years with easy renewal.

- Extra Subsidies – Repay on time and save more with government schemes.

What Makes the Kisan Credit Card Special?

- Loan Limit: ₹10,000 to ₹3 lakh 💳 based on your farming needs.

- Interest Rate: As low as 2% with government subsidies.

- Validity: 5 years (Renewable without hassle).

- ATM & Debit Card: Get a RuPay KCC Debit Card to withdraw cash anytime.

- No Collateral Needed: Loans up to ₹1.6 lakh are collateral-free.

- Insurance Included: Protect yourself against crop failure.

Who Can Apply for a Kisan Credit Card?

- Any ✅ Indian farmer (individual or joint cultivators).

- Tenant farmers, sharecroppers, dairy & fisheries entrepreneurs.

- SHGs (Self-Help Groups) engaged in farming.

- Must be 18-75 years old with a basic farming background.

The Magic of Kisan Credit Card e-Sewa

Gone are the days of standing in long queues! ⏳ With e-KCC services, farmers can now:

- Apply for a KCC online 💻 hassle-free.

- Check loan status from their mobile.

- Update KYC details without visiting the bank.

- Renew loans digitally with a single click.

What’s the Interest Rate?

Worried about high interest? 🤨 Don’t be! The KCC comes with government subsidies that reduce the interest burden.

- Base rate: 7% 💰

- With timely repayment: As low as 4%

- Additional government subsidy: Up to 3%

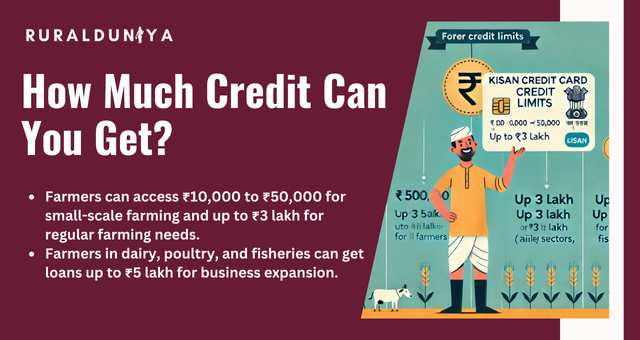

How Much Credit Can You Get?

- ₹10,000 – ₹50,000 for small farmers.

- Up to ₹3 lakh for regular farmers.

- Higher limits up to ₹5 lakh for allied sectors (dairy, poultry, fisheries, etc.).

How to Apply for a Kisan Credit Card?

- Online: Visit your bank’s website 📋 , PM Kisan portal, or SBI e-KCC.

- Offline: Head to any nationalized bank, cooperative bank, or RRB.

- Through CSCs: Apply via Common Service Centers in rural areas.

Step by Step Application Guide

- Visit the bank or go online (SBI, ICICI, HDFC, NABARD, etc.).

- Submit documents – Aadhaar, PAN, land records, income proof.

- Verification & Approval – The bank processes your request.

- Get Your Card! – A RuPay Debit KCC Card is issued.

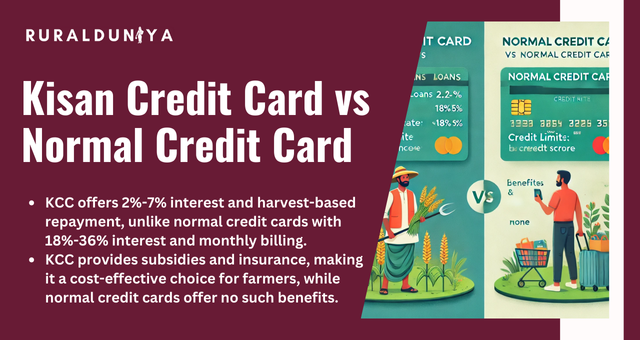

Kisan Credit Card vs Normal Credit Card: Which One’s Better?

| Feature | Kisan Credit Card (KCC) | Normal Credit Card |

|---|---|---|

| Purpose | Farming-related loans | Shopping, travel, bills |

| Interest Rate | 2%-7% (with subsidies) | 18%-36% |

| Repayment Cycle | Harvest season-based | Monthly billing cycle |

| Credit Limit | Up to ₹3-5 lakh | Based on credit score |

| Government Benefits | Insurance, subsidies | Bonus points |

Introducing the Kisan Gold Card

Looking for a premium farming credit solution? 🌟 Enter the Kisan Gold Card!

- Higher Loan Amounts – Get up to ₹10 lakh 💳 based on your landholding.

- Better Interest Rates – Exclusive government-backed low rates.

- No Collateral Needed – Loans up to ₹2 lakh without security.

- Extended Validity – Enjoy 7-year loan cycles.

Kisan Credit Card Login: Manage Your Card Online!

Access your KCC details online in minutes: ⏱️

- Visit your bank’s website.

- Click on KCC login.

- Enter registered mobile number & OTP.

- Check loan balance, repayment details & available credit limit.

Need a Copy? Here’s How to Download Your KCC

Farmers can easily download 🖨️ their KCC details via:

- PM Kisan Portal – Get digital copies linked to Aadhaar.

- Bank’s Mobile App – SBI YONO, PNB KCC, etc.

- CSC Centers – Print your KCC details instantly.

Need Help? Kisan Credit Card Toll-Free Helpline

Got a query? 🤔 Call these toll-free numbers for instant support:

- SBI: 1800-11-2211

- PNB: 1800-180-2222

- PM Kisan Helpline: 155261

- NABARD Support: 1800-102-4455

The Final Word

The Kisan Credit Card is more than just a loan facility—it’s a financial safety net for farmers. With low-interest rates, flexible repayment options, and digital access, it’s the ultimate solution for modern-day farming. Whether you need funds for seeds, equipment, or emergencies, your KCC has got your back!

So, if you’re a farmer, don’t wait—apply for your KCC today and enjoy the benefits of hassle-free farming finance. 🚜💰

FAQs

Who can apply for a Kisan Credit Card?

Any farmer in India, including tenant farmers and dairy or fishery owners, can apply. You need to be 18-75 years old.

How long does it take to get a Kisan Credit Card?

If all documents are correct, banks usually approve and issue the card within 7-15 days.

What is the interest rate for Kisan Credit Card loans?

The base interest is 7%, but with government subsidies, it can go as low as 2-4% if repaid on time.

Can I use my Kisan Credit Card for non-farming needs?

No, the loan is strictly for farming expenses like seeds, fertilizers, machinery, and related activities.

Nishank is a social impact enthusiast with a solid foundation in public policy, micro-enterprise, and agribusiness. Growing up in a farmer’s family has given him a profound connection to rural communities, fueling his passion to empower people towards self-reliance. He completed his undergraduate studies at the Delhi University and earned a master’s degree in Rural Management from National Institute of Rural Development & Panchayati Raj in Hyderabad.