The Pradhan Mantri Mudra Yojana (PMMY) aka Mudra Loan is a transformative initiative by the Government of India, aimed at providing financial assistance to small businesses and entrepreneurs.

Launched in 2015, this flagship scheme emphasizes “Funding the Unfunded” by offering loans up to ₹10 lakh without collateral, fostering financial inclusion and boosting the nation’s economic growth.

Mudra Loan Yojana: Empowering India’s Entrepreneurs

The Mudra Loan Yojana was introduced to cater to the needs of non-corporate, non-farm micro-enterprises engaged in manufacturing, trading, and services. The scheme’s objective is to provide easy access to formal financial services for these small businesses, often overlooked by traditional banking systems.

These loans are made available through public and private sector banks, regional rural banks, cooperative banks, and microfinance institutions. The loans are divided into three categories—Shishu, Kishor, and Tarun—tailored to meet the varying financial needs of businesses at different growth stages.

With competitive interest rates and minimal documentation, these loans empower entrepreneurs to set up or expand their ventures with ease. As of recent statistics, these loans have benefitted over 37.4 crore borrowers, disbursing more than ₹23 lakh crore.

With women entrepreneurs comprising a significant share of beneficiaries. These loans have been instrumental in empowering micro and small enterprises, enabling them to thrive in a competitive market.

Mudra Loan Types

It is categorized into the following tiers to suit businesses of different scales and needs:

- Shishu:

- Loan amount: Up to ₹50,000.

- Designed for startups or businesses in their infancy to cover initial expenses such as equipment, raw materials, and setup costs.

- Kishor:

- Loan amount: ₹50,001 to ₹5,00,000.

- Suitable for businesses in the growth stage requiring additional capital to increase productivity or expand operations.

- Tarun:

- Loan amount: ₹5,00,001 to ₹10,00,000.

- Targets established businesses needing substantial funding for scaling operations, upgrading equipment, or entering new markets.

- Tarun Plus:

- Loan amount: Above ₹10,00,000 (offered under select bank-specific schemes).

- Tailored for businesses with significant capital requirements to achieve large-scale growth.

Mudra Loan Through SBI

The State Bank of India (SBI), India’s largest public sector bank, actively supports the PMMY scheme by providing Loans across all categories.

With user-friendly application processes and nationwide branches, SBI ensures that entrepreneurs can easily access the financial assistance they need. Applicants can visit the nearest SBI branch or apply online for Loans with minimal documentation and flexible repayment options.

Mudra Loan Through Union Bank

Union Bank of India is another key participant in the Mudra Yojana, offering loans under Shishu, Kishor, and Tarun categories. With its extensive branch network, the bank supports entrepreneurs by providing end-to-end guidance, from loan application to fund disbursement.

The bank’s simplified processes make it an attractive option for small businesses seeking Loans.

Mudra Loan Through HDFC Bank

HDFC Bank, a leading private sector bank, facilitates Loans with efficient service and competitive interest rates. Entrepreneurs can apply through both online and offline channels, enjoying benefits like quick processing and personalized support.

HDFC Bank’s commitment to customer-centricity ensures that small business owners can avail themselves of financial assistance seamlessly.

Documents Required for Mudra Loan

To apply for a Mudra Loan, the following documents are typically required:

- Identity proof (Aadhaar card, PAN card, Voter ID, etc.)

- Address proof

- Business plan or proposal

- Bank account statement (last six months)

- Proof of business existence

- Passport-sized photographs

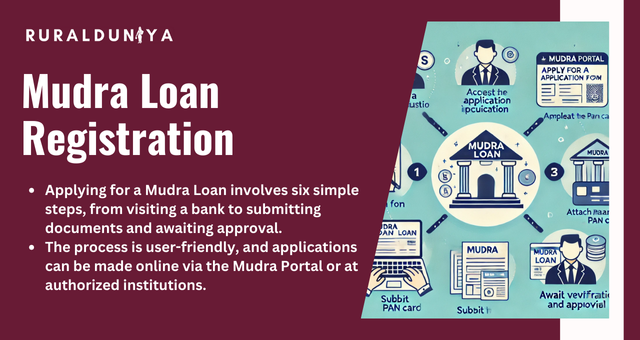

Mudra Loan Registration

Registering for it is simple and accessible. Follow these steps:

- Visit a financial institution: Approach any bank or microfinance institution authorized to offer Loans.

- Access the Mudra Portal: Alternatively, visit the official Mudra Portal to apply online.

- Complete the application form: Fill out the loan application form with details of your business, loan requirements, and repayment plan.

- Attach necessary documents: Aadhaar card, PAN card, Voter ID, Business proposal etc.

- Submit the application: Provide the completed form and documents to the bank or upload them online.

- Await verification and approval: The bank will review your application and process the loan.

Mudra Loan Eligibility

Eligibility criteria for these Loans are:

- Applicants must be Indian citizens aged 18–65 years.

- Entrepreneurs engaged in non-farm sectors like manufacturing, trading, and services are eligible.

- The business should be classified as a micro or small enterprise under the MSME guidelines.

- A viable business plan or proposal is required.

Mudra Loan Portal

The Portal (www.mudra.org.in) is a comprehensive platform offering details on eligibility criteria, loan types, required documents, and interest rates. The portal also enables online applications and provides updates on loan status.

Mudra Loan Interest Rate

These Loans are offered at competitive interest rates, generally ranging from 7% to 12% per annum, depending on the category and lending institution. The government ensures affordability by waiving processing fees, making the loans accessible to small businesses.

Mudra Loan Subsidy

While the scheme does not offer direct subsidies, borrowers benefit from low-interest rates, zero collateral requirements, and government-backed support.

Women entrepreneurs and individuals from economically weaker sections may avail of additional benefits under specific government initiatives.

Mudra Loan for Women

The Mudra Yojana prioritizes empowering women entrepreneurs, offering them reduced interest rates and faster processing. This initiative has significantly increased the participation of women in India’s entrepreneurial ecosystem, fostering financial independence and community growth.

Mudra Loan for New Businesses

For startups and new ventures, Loans under the Shishu category provide financial support of up to ₹50,000. These loans cover essential expenses such as equipment purchase, working capital, and marketing, helping entrepreneurs establish their businesses.

What to Remember

The Pradhan Mantri Mudra Yojana has been a game-changer in India’s economic landscape, enabling micro and small businesses to thrive. By offering collateral-free loans with competitive interest rates, the scheme has empowered millions of entrepreneurs to achieve their dreams.

Whether it’s a budding startup or an established small business, Mudra Loan provide the financial foundation needed for success.

FAQs

Who can apply for a Mudra Loan?

Any Indian citizen aged 18–65 years, engaged in non-farm small businesses like manufacturing, trading, or services, can apply with a viable business plan.

Is collateral required for Mudra Loans?

No, these Loans are collateral-free, meaning borrowers don’t need to provide security or guarantors.

What is the maximum loan amount under Mudra Yojana?

The maximum loan amount is ₹10 lakh, with higher limits available under bank-specific schemes like Tarun Plus.

How do I apply for a Mudra Loan online?

Visit the official Mudra Portal, complete the application form, upload documents, and track your loan status online.

Nishank is a social impact enthusiast with a solid foundation in public policy, micro-enterprise, and agribusiness. Growing up in a farmer’s family has given him a profound connection to rural communities, fueling his passion to empower people towards self-reliance. He completed his undergraduate studies at the Delhi University and earned a master’s degree in Rural Management from National Institute of Rural Development & Panchayati Raj in Hyderabad.

I want to buy a constructed house, so i want Mudhra loan for this.